So, you want to buy a house, but you don’t have the cash to buy it outright? Well, if you don’t have any rich friends or relatives that want to give you the money then you are going to have to finance it.

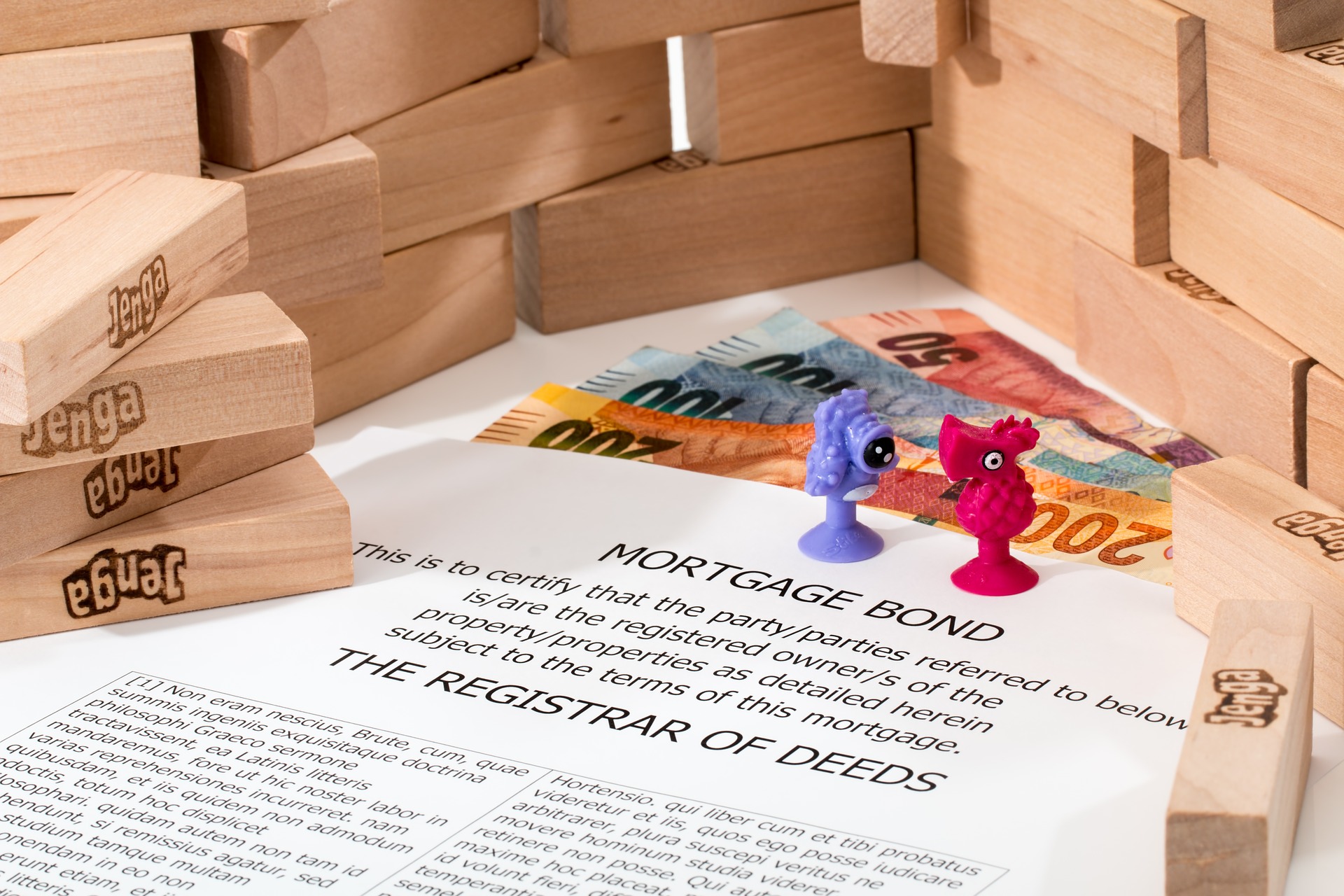

The financing vehicle that is used to purchase a home is called a mortgage. The home is used as collateral to guarantee the balance of the note. It layman’s terms that means that if you don’t pay the loan, then the bank gets your house.

Mortgages are a mystery to many, so don’t worry. You aren’t alone. As teens our only exposure to mortgages are the trade-off that we get leveraging Park Place in Monopoly. But, many people don’t really understand the basic principles of mortgages.

Mortgage payments are typically made up of four components that are principle, interest, taxes, and insurance (PITI). However, the principle and interest are what you are paying to the lender for your home.

Understanding Escrow

You might be wondering why the taxes and insurance are included with the payment then. Easy! Taxes and insurance are usually paid in large lump sums that can often become burdensome when the money comes due. Lenders let you may monthly and save the money for the due dates of these items. This is often referred to as escrow.

Your lender will usually evaluate your escrow balance on a yearly basis. Based on the policy and the tax year, you could have an escrow overage or shortage. The lender will then reach out to you to reconcile or create a payment plan.

Terms of the Loan

Understanding the terms of your loan is one of the most crucial pieces of the loan process as it shows you where your money is going.

Mortgages are like sandwiches. There are a million ways to make them. If you ask someone to make you a sandwich without any direction, the chances of you getting the sandwich that you want are very slim.

The first thing you will want to know about your loan is if it’s and adjustable rate, also referred to as an ARM, or a fixed mortgage. The interest rate on an adjustable rate mortgage will change as the loan progresses, where as a rate on a fixed mortgage will stay consistent the entire length of the loan.

You will also want to address the length or term of the loan. Morgages are typically offered as 30-year, 25-year, 20-year, 15-year, and 10-year options. You will have to figure out what works best for your budget.

The general rule of thumb is that the longer the term, the lower the payment, and the shorter the term, the lower the interest rate. This doesn’t always hold true, but it will most of the time.

If there are major problems with the home like a bad roof or foundational issues, you may not qualify. Be sure to call a roof leak repair company or structural engineer to take care of those types of issues.

Who Takes My Payment?

Take a moment to figure out who your servicer is. The servicer is the organization that collects your payment. It may not be the same as your lender, so you will want to take note.

It is very common for mortgages to be sold behind the scenes, and your servicers will change. This isn’t something to stress about. If you accidentally make a payment to your old servicer, they will usually just forward it over to your new one.

Mortgages don’t have to be scary. Work with a loan officer that you feel comfortable with and will answer your questions. This will put a lot of your nerves at ease throughout the loan process. Make sure that you understand the milestones of your loan, the terms, and payment, and you’ll be fine.